Credit card debt continues to be a significant challenge for many Americans, with balances reaching $1.14 trillion in the second quarter of 2024, according to the Federal Reserve Bank of New York. For households with credit card debt, the average owed was $21,367 as of December 2023. If you’re feeling the weight of credit card debt and are ready to take steps toward lowering or eliminating it, you’re not alone—and there are strategies to help you regain control of your finances. Here are some practical tips on how to get rid of credit card debt and work toward financial freedom.

How To Get Rid of Credit Card Debt?

- Use a Balance Transfer Card

Did you know you can transfer your credit card debt to a new card and save money on interest? Balance transfer credit cards provide a 0% introductory interest rate for a certain period—typically 12 to 18 months—allowing you to focus on paying off your debt without accruing additional interest. Transferring your debt from high-interest cards to a balance transfer card will drastically cut your overall payback costs. This can be a wise decision if you have a solid repayment plan and can pay off most or all of the sum before the promotional period expires.

While it may seem contradictory to establish a new credit card when trying to pay off debt, a 0% balance transfer card can be an effective tool in your repayment strategy. Select a card with a lengthy interest-free period and consolidate your existing credit card balances into just one account. This reduces your payments to a monthly cost, allowing you to focus solely on lowering your principal balance. Remember that some balance transfer cards may impose a transfer fee (often 3% to 5% of the transferred amount), so incorporate this into your overall savings strategy.

- Lower Your Living Expenses

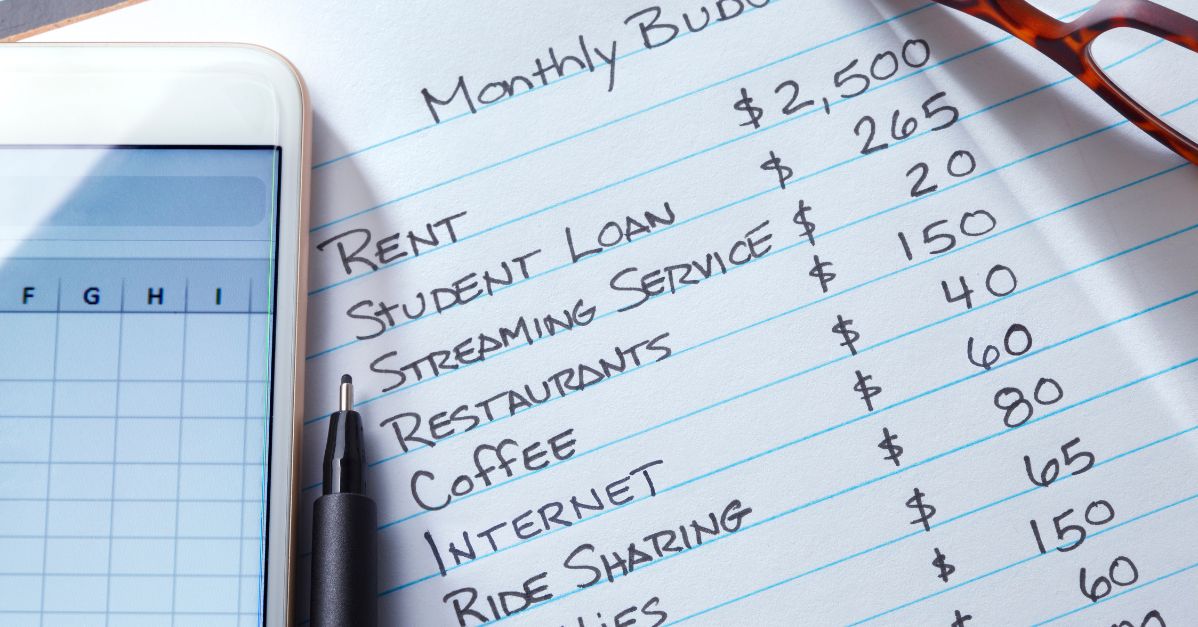

Living within your means is an effective way to reduce credit card debt and achieve financial security. Begin by reviewing your living expenses and identifying where you may reduce them. For example, bargain with service providers for better deals on necessities like internet, cell phone plans, and insurance. Many businesses are eager to give discounts or more inexpensive packages if you inquire. Lowering these recurrent expenses can free up more money to put toward your credit card debt.

Adopting a frugal lifestyle will help you get out of debt faster. Prioritize free or low-cost activities like visiting local parks, attending community events, or finding amusement through hobbies at home. Avoid using credit cards for discretionary purchases and instead adhere to a cash budget for things like dining out or non-essential shopping. Setting clear financial boundaries and focusing on requirements ensures you minimize your debt as much as possible while avoiding adding to it.

- Debt Relief With Mediator Debt Solutions

If your debt has become unmanageable and you’re struggling to make even the minimum monthly payments, it may be time to explore debt relief options like debt settlement. Debt settlement is a viable option for those experiencing genuine financial hardship. Creditors often prefer recovering a portion of the debt rather than nothing, making negotiation a practical solution for many Americans overwhelmed by debt. Debt settlement involves negotiating with said creditors to reduce the principal balance you owe. At Mediator Debt Solutions, we specialize in negotiating with creditors on your behalf to lower your principal balance and help you regain financial stability.

If you find it impossible to keep up with your payments, debt settlement could allow you to pay less than what you owe while avoiding more severe consequences like bankruptcy. To explore how debt settlement can help you, contact Mediator Debt Solutions today.