Mediator Debt Solutions

Mediator Debt Solutions has been working in the debt settlement industry for years and time and time and again – we’ve been able to see success story after success story for people who qualified for our programs. But before they came to us, many of them didn’t know debt settlement was even an option or let alone a thing! Here’s the fast and simple version of how debt settlement works.

Your Debt Situation

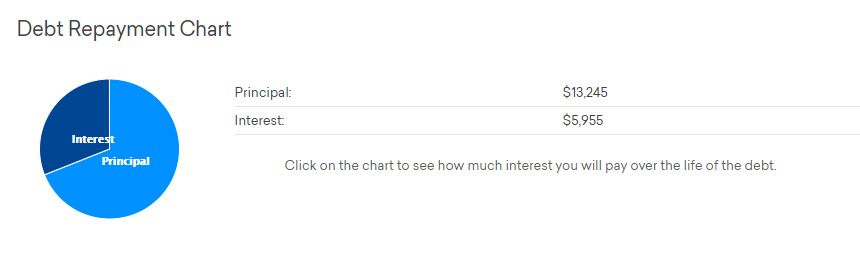

You currently have $10,000 in debt or more. Let’s say $10,000 for this example. And let’s use Credit Karma’s Calculator to run some numbers. $13,000 at 29.99% in interest with a minimum payment $600 could be theoretically paid off in about 36 months. But look at the interest you’d pay:

A pay off in 3 years but you pay $6,000 in interest. If you lower the payment to $400.00 your pay-off date goes to 68 months and your interest sky-rockets to over $14,000. This is one of the biggest problems with debt. Interest hurts you over time but time is what people often need to pay back their debts. Add to that the risk of missed payments, unforeseen expenses… and you have a recipe for financial disaster.

For what it’s worth, ABI statistics shows that in the month of January 2021 there were over 30,000 bankruptcies filed across the country. It’s no wonder that the number is that high when you consider how easy it is to spiral into uncontrolled debt with just a few difficult moments in your life. The problem with Bankruptcies is that, for one, they come with costs. Secondly, they’re public. In other words, your credit report will show your bankruptcy for a very long time. “Debt settlement on the other hand,” says Armen Tatiyants of Mediator Debt Solutions, “provides you with relief in a shorter amount of time and the process itself is private.”

That’s not all. Remember the crippling interest we talked about? Well, you stop burning money in interest payments practically day 1 when you start with our programs at Mediator Debt Solutions. So, debt settlement offers clients a quicker pay-off date, a lower pay-off amount, and no interest on top of it. So how does it work?

The Process behind Debt Settlement with Mediator Debt Solutions

Mediator Debt Solutions has a team of experts that works with you every step of the way.

- We assess your debt situation to create a customized plan that fits you specifically

- We then create a special savings account to begin depositing for your coming settlement pay-off (payments are less than your credit card payments so that’s money in your pocket right away)

- Our team of expert negotiators begins working with creditors to settle your debt

- We then pay off the settlement and you are now on your way to being debt free

Assess Your Debt Situation

Our team goes through your debt situation and tailor makes a custom plan that’ll fit your needs in terms of your pay-off, your monthly savings, and the debt you have. We look at each of your accounts and make accurate estimates of what the best course of actions is. We help answer any questions you may have and set you on the path towards debt settlement!

Special Savings Account

Let’s imagine your debt is at $13,000 and estimate that we can reduce the amount you owe to $4,000 (we often save more and do it faster but we are conservative in our estimates to manage your expectations correctly). We also estimate that we can have the settlement ready to go in 16 months. To save that amount, you would deposit into a special savings account $250 a month to cover the settlement in about 16 months. $250 is way less than you’d pay otherwise and, unlike making minimum payments, you don’t lose thousands to interest. Mediator Debt Solutions has years of experience in both the settlement process and the preparation process so, as we said before, we often beat our estimates (but every case is different).

Working With Creditors

We’re a performance based company. We don’t get paid if you don’t save. And our fee is a percentage of ONLY what you save. What does that fee cover? For once, our team’s enrollment process that we mentioned previously. But mainly, the process going forward as well. We reach out to creditors, we negotiate with them, we work with them and eventually settle with them. So, while it is possible to do this on your own, the reality is that not only is the process massively time consuming but our experience helps us get rates most people can’t. We know how hard and how long to push. After all, Mediator Debt Solutions has been at it for years!

Pay-Off and Debt Free

When a settlement amount is reached, we use your special savings account funds to pay out the settlement. Anything left over is returned to you. At this point, with the burden of massive debt lifted from you – the sky is the limit. You can now begin your journey to better credit and maintaining a debt free life.

And the best part? Mediator Debt Solutions is with you every step of the way.